WSU students now offered multiple health insurance options

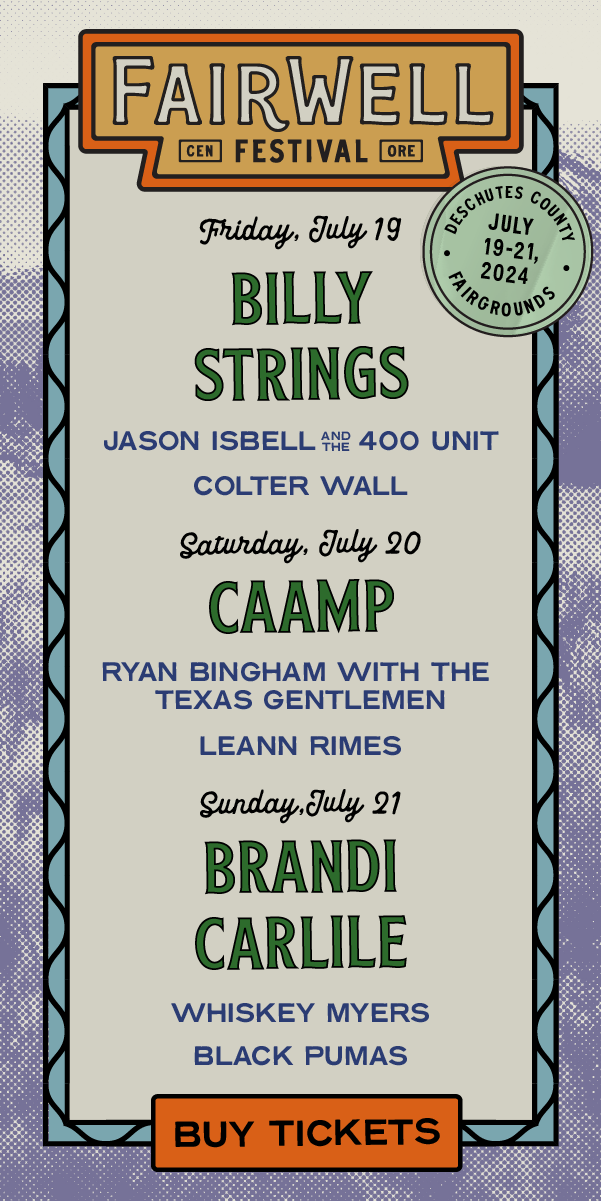

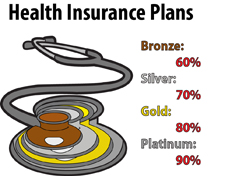

Insurance plans offered to students through The Exchange come in four tiered coverage levels. For each level individuals pay a certain percentage of the insurance costs with the insurance provider paying the remainder. The numbers above represent the amounts covered by the provider.

October 7, 2013

By 2014, every American citizen must have healthcare insurance.

To help students acquire insurance, WSU is offering options through either the university or the Washington State Health Benefit Exchange.

The Exchange calculates cost based on the individual, considering special circumstances.

“The coverage and premium are based on incomes, so you could qualify for a Medicaid premium of zero,” said Merry Lawrence, billing insurance manager and student insurance coordinator. “It is not as comprehensive as a student plan, but families can afford it.”

As part of the Affordable Care Act, also known as Obamacare, people who do not have health insurance by 2014 will be fined $95. The fine will increase each year for someone who does not have insurance – up to $325 in 2015 and $695 or 2.5 percent of household income in 2016. For families, the penalty will be $2,085 or up to 2.5 percent of household income.

In response to these new requirements, WSU now offers multiple options for health insurance. If students cannot afford insurance through the university, the university’s Health and Wellness department can guide them through The Exchange, which opened on Oct. 1 and deals with multiple insurance companies.

Although insurance through The Exchange may be a cheaper option, some students still have apprehensions.

“Financially I can’t even afford health insurance through WSU, so I have health insurance through my parents,” student Ashlie Olson said. “It’s just one more thing I would have to think about.”

Olson said she would not shop through The Exchange because she can remain on her parents’ plan with the new requirements.

Similarly, WSU student Easton Wright is also on his parents’ plan. He said removing himself from his parents’ plan would not provide financial stability right now.

”After I graduate and have a steady income it would be more of an option. I haven’t shopped for any (insurance providers) yet,” he said.

The plans through The Exchange are tiered Bronze, Silver, Gold and Platinum. People can go online and enter personal information to see what plan they qualify for. For Bronze, individuals pay 40 percent of insurance costs; Silver, 30 percent; Gold, 20 percent; and Platinum, 10 percent.

While insurance through The Exchange may be tailored to each person, WSU Student Health Insurance also offers certain benefits.

Many students don’t know that the Affordable Care Act will also cover preventative treatments, such as immunizations, birth control and STI testing, Lawrence said.

“Our insurance follows the Affordable Care Act criteria – there are ten criteria that must be included,” Lawrence said. “Student insurance has more benefits, more comprehensive and a larger deductible, it pays 100 percent. Also, student health insurance is completely portable. It works in and out of the United States.”

For international students, they can only purchase student health insurance. As visitors, they do not fall under the federal requirements to purchase insurance from The Exchange, Lawrence said.

Employees who have health insurance provided by their employer at a reasonable rate are also exempt, he said.

While The Exchange and WSU insurance are different, it is possible to implement some of The Exchange aspects into WSU’s upon student request.

“One of the major functions is that students make recommendations,” said Angie Funaiole, graduate student and member of the Counseling and Student Health Advisory Committee. “Students can also take part in the annual insurance plan review. Insurance is tricky enough, it is hard to know what students want and how to improve.”

For those that currently do not have insurance and need to obtain a policy before the start of 2014, Health and Wellness offers open enrollment before spring of next semester.

Students with seven or more credits are eligible for the General Plan, and international students are registered automatically for the plan, though they may not have to pay if they can prove comparable insurance, according to the website.

Pullman Regional Hospital offers insurance information help with social workers who help community members navigate the system and find the best coverage.

Students who would like more information can go online to the Health and Wellness website, Washington Health Benefit Exchange or The American College Health Care Association.