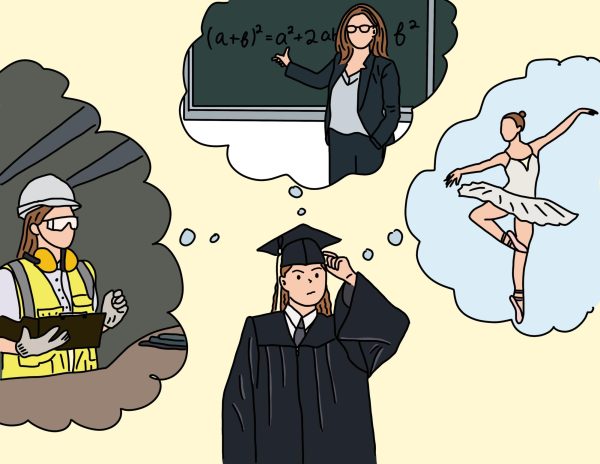

How to survive life as a broke college student

Prioritize what you need to avoid wasting money on useless items

DYLAN GREENE | EVERGREEN PHOTO ILLUSTRATION

Canned food and ramen noodles can become staples of a college student’s diet, but learning how to budget your money responsibly can take the stress out of worrying about where your next meal is coming from.

August 10, 2018

If any experience slaps you with the full force of a reality check, it’s handling college finances.

Here in Pullman, the number of student-friendly discounts and secondhand shopping options make saving money much easier, but it’s still common to struggle with keeping money in your bank account. Here’s a guide from a broke college student like myself about how to handle that struggle.

Work over the summer

It may be too late to do this now, but find a job in retail or something fairly easy that offers a significant amount of hours. Having to give up a portion of your summer break is a drag, but if you spend the summer saving up money you will thank yourself during the semester when you’re pulling all-nighters and need a Red Bull to stay awake.

Make a budget

Tanner Hendrickson, a senior economics major who also works at the Pullman Chamber of Commerce, said the first thing you should do is divide up the different expenses you’ll have throughout a month.

Depending on your circumstances, this means setting aside how much you’ll need for rent and other housing bills, groceries and gas.

“I would also advise not eating out all the time, since that adds up quick and you definitely don’t need to be doing that,” Hendrickson said.

It’s also a good idea to set aside a small percentage of weekly pay for a rainy day fund, since you never know where your money might be needed.

I would suggest that 10 or 20 percent of your check is allocated into a savings account. That way you won’t be tempted to use it on purchases you know deep down you don’t need.

Get creative with hobbies

It’s expensive to go out most of the time. When you’re out with friends, it’s easy to fall into a trap of buying something when you don’t need to be. For fun, free things to do, I’d recommend spending time around campus since there’s usually an abundance of food and people without the cost.

With many walking paths and a short drive to places like Granite Point and Kamiak Butte, finding something fun to do can actually be an easy process.

Hendrickson said he spends his time fishing, because as long as you have a license and a pole, it isn’t an overly expensive pastime.

I personally love any of the local libraries, which is also a great way to save money and explore new books you want to read.

Thrift, thrift, thrift

I have a profound love for secondhand shops of any kind. Places like the Hope Center and Goodwill in Moscow are two of my favorites in the area to find fantastically low prices for cute clothes instead of spending money at an expensive boutique.

The Hope Center in particular also sells common household items, including coffee makers, dishware and a limited variety of furniture. There are also bargain bookstores and local antique shops that sell unique items for a low price.

This isn’t to say you should never treat yourself, because sometimes spending money for things you’re passionate about is a satisfying experience. The idea is to make sure you’re prioritizing things you need and not spending money when you’ll need it soon.