Expert panel breaks down recession causes

March 12, 2014

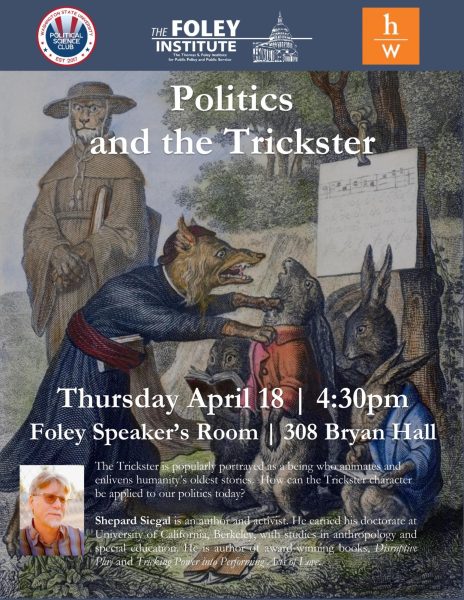

A group of WSU students and community members listened Tuesday evening as experts discussed the merits and failures of financial reforms put into place following the 2008 economic crisis.

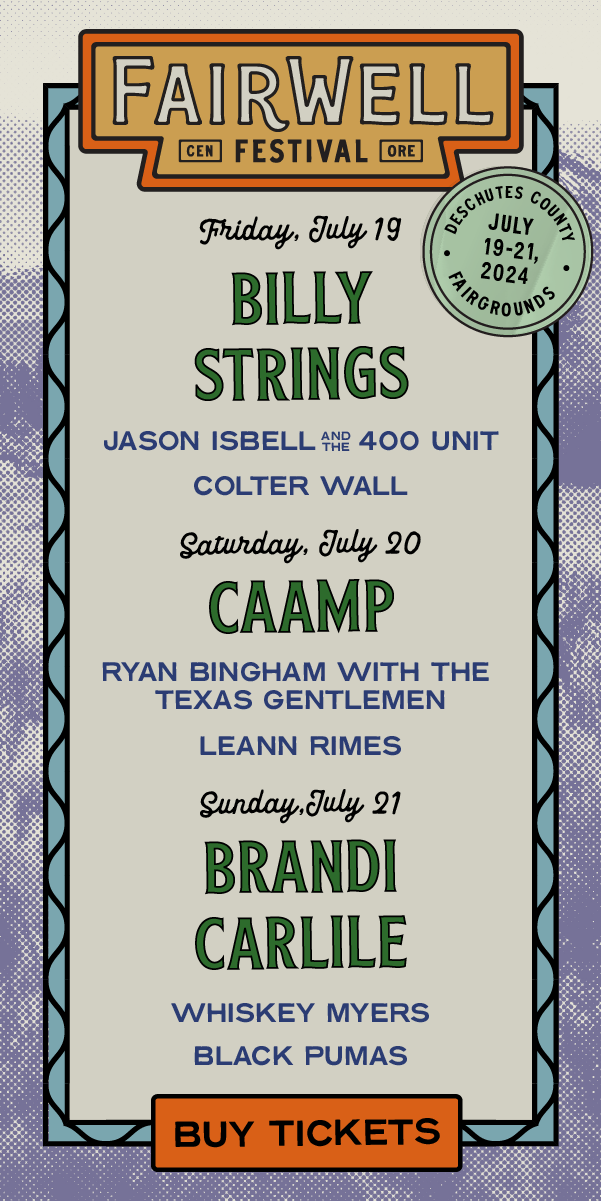

The WSU Foley Institute teamed up with the College of Business to set up a panel of financial experts and delve into the cause and legislative response to the economic downturn.

The panel began by explaining how the economic crisis got started in the first place.

“In the old days, what would happen is a bank would originate a mortgage and hold it in their own portfolio,” said Jerry Kallberg, Alvin J. Wolff Distinguished Professor of Real Estate at WSU.

Kallberg said just before the crisis, this changed. Financial institutions began repackaging and selling off groups of mortgages. Demand for these mortgage bonds grew rapidly, Kallberg said, but no one was being transparent about how dangerous many of these investments were. Eventually, these mortgage bonds began to lose money, and institutions that heavily invested in them began to fail, Kallberg said.

One of the legislative responses to the economic crisis was the Dodd-Frank Act, which placed regulations on banks in a legislative attempt to prevent a similar crisis from happening in the future.

“There were some good things that have come out of Dodd-Frank, but it was a very rushed piece of legislation,” said Richard Riccobono, director of banks at the Washington State Department of Financial Institutions’ Division of Banks.

“Sometimes you have to pass a bill to know what’s in a bill,” Riccobono said.

The bill was well intended, and it tried to solve problems, but ultimately it may have exacerbated the problem by causing banks to slow down lending, Riccobono said.

“I’m not sure we understood what the problems were then,” Riccobono said. “I think we should have done studies before we passed legislation.”

One panelist said he held regulators mainly responsible for the crisis.

“In my view, a lot of the problems are because of the lousy job done by the regulatory agencies, they failed us,” said Jim Barth, the Lowder Eminent Scholar in Finance at Auburn University.

Barth said regulators were similar to referees in sports because both are biased and end up giving an advantage to the home team.

“You know who the home team is? The institutions they are supposed to regulate,” Barth said. “You know who the away team is? The public.”

Students attending the event said they appreciated the diverse perspectives and qualifications provided by the panel.

Junior entrepreneurship major Bryce Deveaux said although he had a decent grasp on how the economic crisis worked before the event, it was interesting to hear the story from both teachers and regulators.