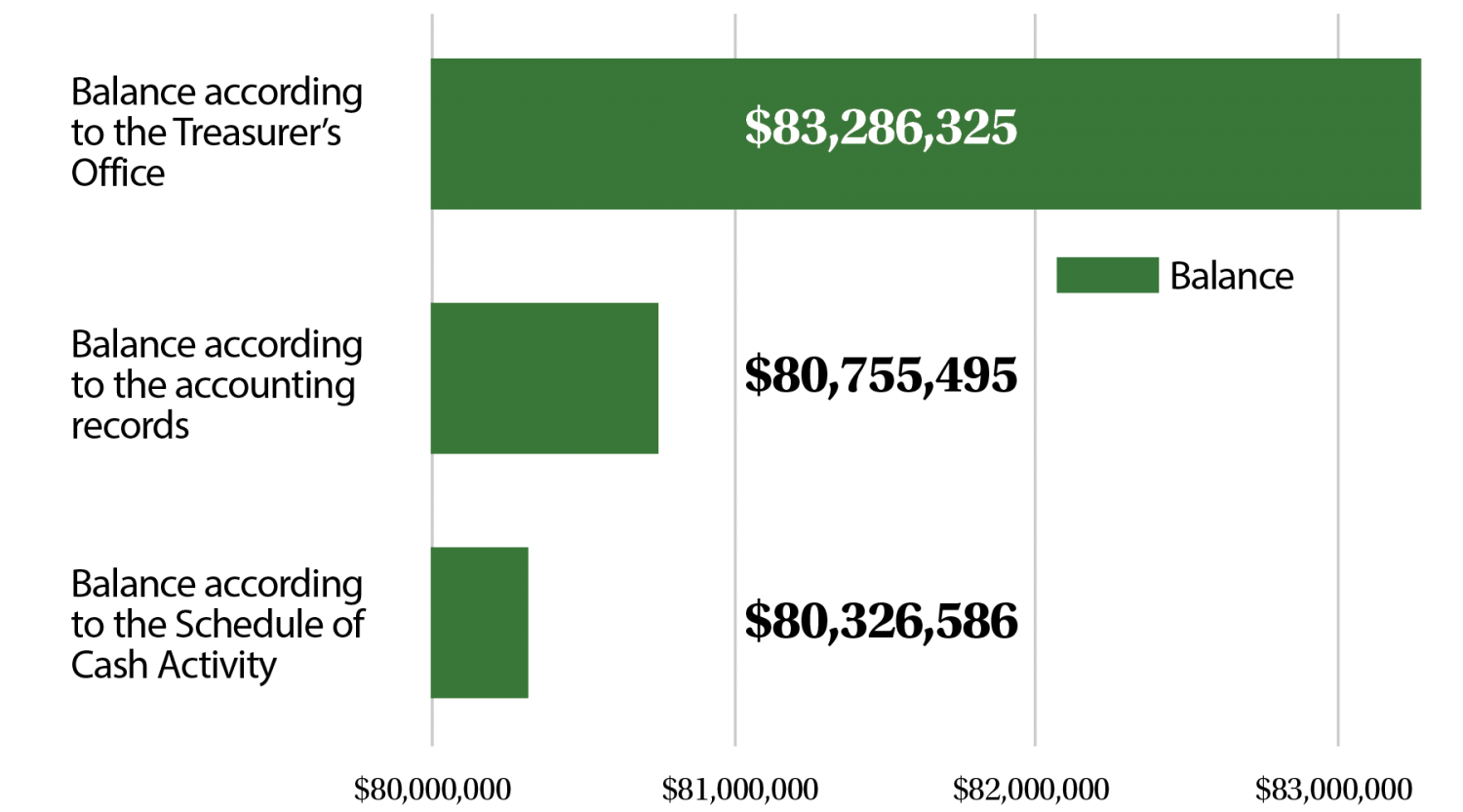

State auditors find variance of $2.5 million in accounting records

Data from the Whitman County Tax Auditor’s Report shows an unexplained $2.5 million discrepancy between the accounting records and the bank balance.

November 29, 2016

Whitman County financial statements lack accuracy because of inadequate internal controls, with only five of the past 11 years being satisfactory, according to recent state audit findings.

The 2015 report, published Monday by the Washington State Auditor’s Office, stated county employees in charge of financial transactions did not understand how to use accounting software or the importance of accurate transaction recording on accounting records.

The county, according to audit findings, was unable to account for $2.5 million worth of variances between ending cash amount and accounting records.

County employees in charge of the financial statement preparation did not have proper training or resources needed to complete the financial reporting accurately, according to the report.

The county also lacked an effective overview process for the accuracy of entering in transactions. It did not have a means of monitoring for errors or checking accuracy of statements to accounting records or bank reconciliations, according to the report.

As a result of the inaccuracies, the state auditor’s office was unable to issue an opinion on the condition of the county’s financial statements. The state audit report includes recommendations for county employees to help improve their accuracy.

Whitman County Auditor Eunice Coker said there were personnel issues in the auditor’s office, involving the loss of their finance director. The finance director was in charge of doing the audit report but was unable to complete it because of her absence, but the office now has the right people and the right number of people to complete it without her, she said.

“It’s been a long, hard struggle over the last couple of years,” Coker said. “Little baby steps have been taken.”

There are three parts to the state audit report, Coker said. The federal audit, which went well; accountability, in which the auditors recommended they tighten the payroll processing; and financial, which the auditors were not able to give an opinion on.

Coker said it is as if there is $2.5 million more recorded in the checkbook than in the check register. She said there is no money missing, it just has to be balanced.

“We’ve been under a bit of turmoil here,” Coker said.

She said the county employees had to integrate a new and modernized numbering system. Everything that money is spent on by the county is given a specific number and the system ran out of numbers, she said. So now the county is trying to move to an updated system but is having difficulty adjusting.

Coker said accounting liaisons from county departments have to be trained to use the new numbering system.

“It’s not going to happen overnight by any means,” she said. “We are going to have to go back and revamp our financial system.”

Coker said they are moving forward, and will work on tightening internal control.

She said the state auditors were helpful with making recommendations in how to improve the county financial system. The county officials told the state auditors they were not able to submit a complete report so they asked the state auditors to issue a ‘no opinion,’ which means they have nothing to look at, she said.

“It would have wasted their time and our money,” Coker said.

She said it could be up to four years before everything gets sorted out.

“I mean this thing is huge,” Coker said. “It’s a huge project.”