Crop Insurance ensures the future of farms

Most Washington farms rely on crop insurance subsidized by federal government

Crop insurance financially covers cops that cannot be sold, like this frost-damaged spring canola from May.

September 23, 2021

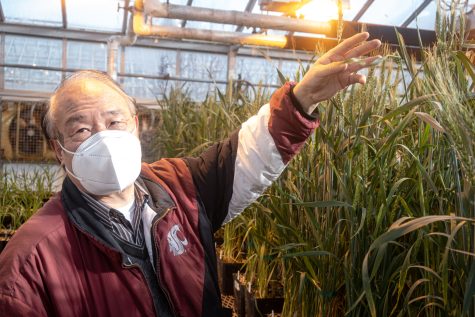

Agriculture is a risky business, which is why farmers rely on crop insurance to cover their losses when prices and crop yields drop.

Most farms in Washington rely on crop insurance, said Randy Fortenbery, WSU School of Economic Sciences professor. Profit margins in agriculture tend to be very small, which is why farms rely on crop insurance.

“There’s not a lot of room to have a disaster and still be solvent to go into the next production year,” Fortenbery said.

Profit margins in farming are low because agricultural commodities are relatively similar, he said. Farmers do not have any control over the price their crops sell.

Without crop insurance, this would have been a year where Washington would have lost quite a few farms, Fortenbery said. So farm insurance is critical to providing a safety net to farmers.

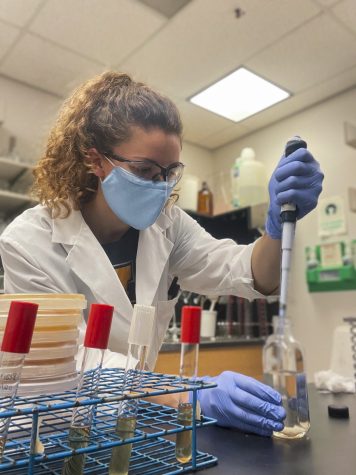

Crop insurance is subsidized by the federal government as a part of the 2018 Farm Bill, said Aaron Esser, regional extension specialist and WSU Wilke Research and Extension Farm management committee chair. The federal government pays part of the insurance premium and farmers pay the remaining balance.

The Wilke farm has 85 percent crop revenue protection, Esser said. Other forms of insurance that farms might have include hail and fire insurance, employee health insurance, building insurance, equipment insurance and liability insurance.

About 75 percent of farmers in Washington use the revenue insurance program, Fortenbery said. Revenue-based crop insurance is most popular with major crops.

There is also yield-based crop insurance, which is determined by the overall yield of a particular crop. If yield is low but revenue is high, then insurance payments are not redeemed, he said.

Revenue insurance covers a ten-year average historical yield, Esser said. When revenue for a particular crop falls below a certain guaranteed percentage, like 85 percent of average revenue, insurance payments kick in. The insurance payments go up to the guaranteed percentage of average revenue but not to the total average revenue.

Specialty crops have their own form of insurance, Fortenbery said. For some crops, there is only one type of insurance available. Crops that do not have a futures market generally do not have revenue insurance.

A futures market is a market where people are trading the certain value of what something is likely to be worth in the future, he said. For example, it would be like predicting the interest rate of stock or mortgage.

“Things like apples don’t have futures market,” he said.

Industrial hemp is an example of a crop that does not have revenue insurance because it does not have a futures market yet, Fortenbery said. Yield-based insurance for hemp was just developed in the last legislation related to agriculture.

“What the general public thinks of [farming] is just some guy out driving the tractor, going across the field and running the combine,” he said. “It is not an easy profession. If it was, there would be a lot more than [under] 2 percent of our overall population as farmers.”