Student feels ripple of financial hardships amid pandemic

Parents of WSU senior quit their jobs due to high risk to COVID-19; student left with $4,000 bill to pay for college

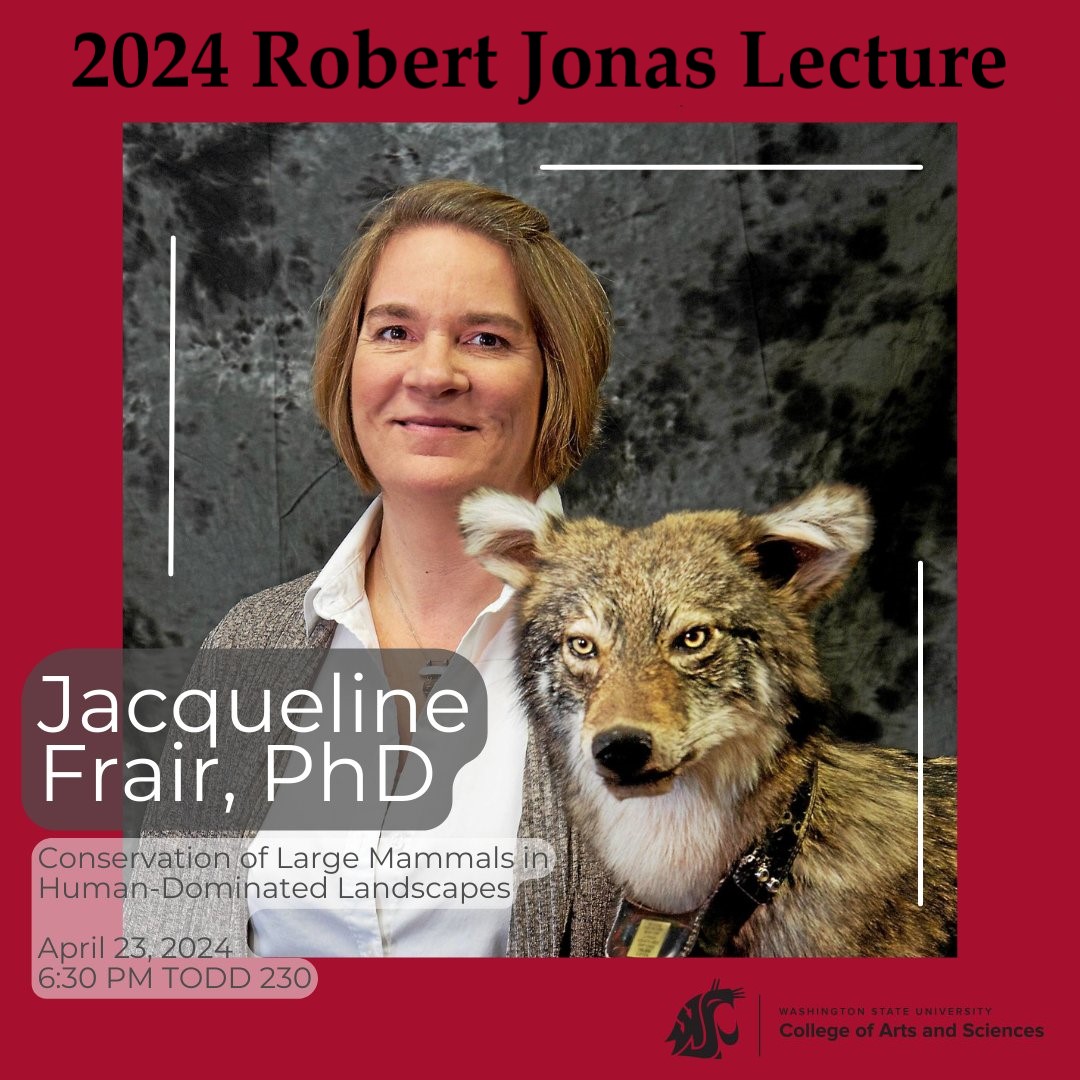

Khadijah Butler (right) moved back home to Las Vegas mid-spring semester to help her mother (left) run errands so her mother can avoid possible COVID-19 exposure.

March 4, 2021

One WSU senior counted on a Pell Grant to cover a chunk of her tuition, like in previous years. However, when she looked over her financial aid package this semester, she still had a $4,000 bill to pay.

In a panic, Khadijah Butler filled out a special circumstance appeal online through the WSU Student Financial Services Office. It was rejected because her mother and father’s incomes were higher in 2020 than in 2019, even though they both have been unemployed for months.

“I always get emails about how the school is supporting us,” said Butler, WSU senior English pre-law major. “I just wish we had actual resources. It just feels like everything is so topical.”

Butler’s mother, DeGina Granderson, worked for the Las Vegas Department of Health and Human Services as a domestic violence hotline operator. Granderson said she came in contact with people constantly.

Granderson said she had no choice other than to quit in November because her autoimmune disease, Lupus, put her at high risk for COVID-19.

Butler said her father, Leslie Butler Sr., worked as a mover where he would go in and out of clients’ homes. Leslie, diagnosed with type 2 diabetes and in the high-risk category, also quit his job in the fall.

Butler said she moved back home to Las Vegas mid-spring semester to help her mother run errands so her mother can avoid possible COVID-19 exposure. While her father still worked, she helped care for her 2-year-old sister.

“Khadijah can always come home,” Granderson said. “I’m concerned about her education because it’s really important to her.”

Butler transferred to WSU from Portland State University her junior year. She moved back to Portland this spring and resumed enrollment at WSU after a semester-long break.

To provide for herself, Butler nannies part-time for a family. She said she logs into Zoom for classes while making sure the two children under 3 years old are safe.

Then, when she gets home, she rewatches the recordings before starting assignments or readings, Butler said.

“It’s like double-dipping,” she said.

After reviewing some of her options with a financial aid counselor, Butler said she will most likely look for a private loan to help cover tuition.

“It’s hard to drop that bill all at once by yourself,” she said.

For students struggling to pay tuition, the WSU Office of Academic Engagement and the Student Financial Services Office offer a variety of resources, including money management courses, emergency grants and a savings match program.

Kelly Demand, WSU director of college affordability programs, said in-state students who qualify for Pell Grants can participate in a match savings program as part of Cougar Money Matters.

Participants receive financial education about budgeting and credit, while they save $1,000 of their own money within six months to a year, Demand said. After completing the financial education, WSU matches the savings by 400 percent to go toward tuition.

However, out-of-state students often do not qualify for these programs due to limitations in funding requirements, Demand said.

“That is where it gets a little trickier,” she said. “Unfortunately, because of the type of funding we receive, we are only able to help in-state students.”

Crimson Community Grants started in fall 2018 and allow any students to apply who are facing financial hardships. The aid grants between $200 to $1,000 per student, Demand said.

The program awarded more than $500,000, but the funding ran dry in the fall. Demand said she anticipates the ability to award more money in July when Coronavirus Response and Relief Supplemental Appropriations Act funding is dispersed.

In December, additional CARES Act funds were passed to provide about $22.7 billion nationwide for higher education. However, WSU has not received funding from the act yet.

“We focus on providing educational needs to students that are in financial hardship,” Demand said. “Whether that is helping them pay some past-due tuition or helping with books and technology. Basically, the items they need to be successful students.”