Tax bill would disparage grad students

Number of students attending graduate school could decrease as taxes make costs unaffordable

ABBY TUTOR | The Daily Evergreen

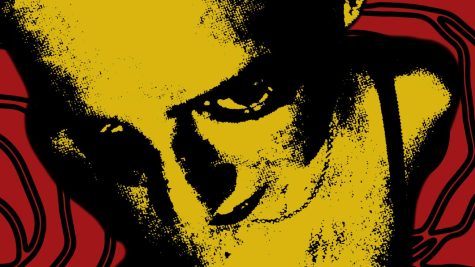

GPSA President Shane Reynolds says the proposed Tax Cuts and Jobs Act would cause students additional stress and that those supporting the bill are undervaluing higher education and research.

November 30, 2017

If Congress passes the Tax Cuts and Jobs Act, many graduate students at WSU will be negatively affected. Proposed as a way to stimulate job growth and improve the real income of the average American, it is little more than a giveaway to the rich at the expense of the lower- and middle-class.

Grad students would be especially hurt by the proposed bill. According to NPR, tuition waivers granted to grad students would be counted as taxable income. GPSA President Shane Reynolds said this money is not a true income for graduate students.

“That money is never actually in the pocket of a grad student,” Reynolds said. “So it’s more or less like taxing them for a number on a piece of paper.”

Supporting the Tax Cuts and Jobs Act undervalues the importance of graduate students and working Americans. The average grad student is already hovering around the poverty line and this tax bill will remove graduate school as a possibility for many.

“Making it more difficult to go to school is only going to drag the economy down more,” Reynolds said.

International graduate students would likely be hurt the most by the bill, Reynolds said. While many grad students can take out loans to cover the tax increase, this is not the case for international students. This might force many of them to look elsewhere for education.

“If you have all these talented students going to other countries to work, suddenly we’re going to start getting behind on our technological advancements,” Reynolds said.

According to the New York Times, international students make up about 80 percent of grad students. If the tax bill is written into law, we will likely lose a significant amount of them.

International or not, grad students should not have to fear such a large jump in their taxes. Education is already stressful enough, and if students have to worry about paying their rent, they can’t focus on the important research they are studying.

The tax cut is simply not for us. Any attempt to frame this as a cut for working families is a farce. By 2021, Americans making under $40,000 a year would see their taxes increase, according to the Congressional Budget Office. By 2027, those making under $75,000 would be worse off. The average income in the U.S. is about $55,000.

Even if we were to believe that the tax cuts would trickle down to lower-income individuals, there is apparently no plan to do so. During a panel about the proposed tax bill put on by the Wall Street Journal, when a room full of CEOs were asked whether they would increase capital investment, only a few hands went up. Average Americans will not benefit from the tax break.

Tax reform needs to happen. The current system is too complicated, disproportionately hurts the poor and working class, and there are too many loopholes that allow corporations to opt out of paying their fair share. This bill might simplify the tax code, but at best, it leaves these other problems unresolved. At worst, it exasperates them.

The current tax reform bill is not for the benefit of students nor does it improve the lives of workers. When our representatives vote for this bill, as our congressional representative Cathy McMorris Rodgers plans to do, they are voting against students.