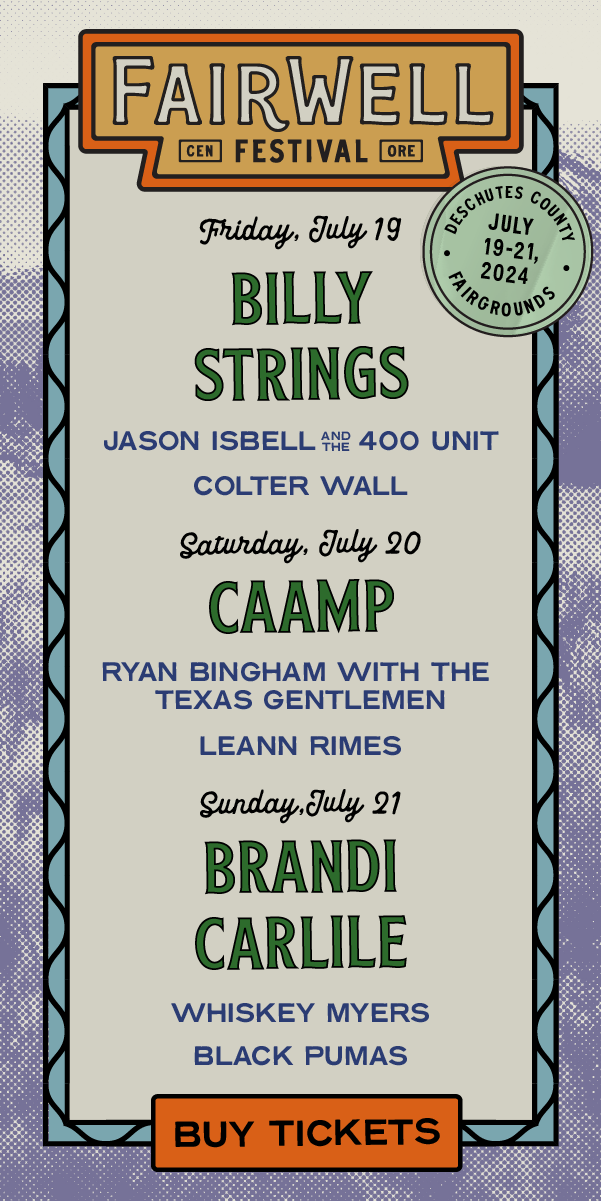

A by-mile tax may not work for the public

January 19, 2017

Over the last two months, it seems a day can’t go by without a front page story about a horrible collision on the winter roads. As many of us are from the west side, we have experienced the treacherous state of Washington’s roads firsthand. There’s a lot of them, and maintaining them isn’t exactly cheap.

Congestion is a mounting problem, according to Mariya Frost, the director of the Washington Policy Center’s Coles Center for Transportation, pointing out congestion has increased 91.2 percent over the past five years.

With the bridge collapse in Mt. Vernon fresh in our memory, we all want something to be done to sort out Washington’s transportation system.

Gov. Jay Inslee has proposed a new tax on drivers to help pay for our road system, a by-mile charge for driving on state-owned roads.

This tax would make up for revenues lost due to fuel efficiency, said Eric Jessup, WSU associate research professor of economics and associate director of the Freight Policy Transportation Institute.

“Washington has one of the highest gas taxes in the nation,” Jessup explained, citing the fact that it is the second highest in the country.

Roads have traditionally been funded via the gas tax, but as not all cars use gas, or use less gas, it’s getting harder to truly track who’s using the roads.

“A heavy truck with a lot of axels does a more damage on the highways,” Jessup said. “If I was going to design one, you’d want a higher [fee] for studded tires and bigger vehicles.”

This tax’s purpose, apart from raising money, would be to reduce the amount of drivers on the roads, lowering congestion.

“It is unlikely that the dollar amount of the mileage tax would get people to change their behavior,” Frost wrote.

Jessup explained that assuming the tax is to be 1.5 cents per mile, and if you have a car that gets under 33 miles per gallon, your tax burden would go down if the gas tax was abolished and replaced with a vehicle mile tax.

The Puget Sound Regional Council estimates over 80 percent of the Puget Sound region will still drive cars in 2040.

It appears that for the time being, when the tax is implemented, the gas tax will also continue to exist, as it is only in a pilot program, according to KIRO News.

This new charge would add yet another cost to a time when it’s getting more and more expensive to get around the state. This tax wouldn’t hurt those who are already wealthy, as they can afford to pay it.

In the small town where I grew up, many residents drove as far as Seattle, more than 50 miles away, every day to go to work. Can you imagine tracking your miles every single day and reporting it to the Department of Licensing? This tax will be a giant stream of red tape around drivers and will punish drivers who are not living in already congested cities.

By-mile taxation was already put to the test in Oregon. Frost mentioned that Oregon holds their system up as the gold standard, saying it is both popular with drivers and raises revenue. However, Frost warns against using the government’s estimation of the issue.

“Even if the tax is ‘successful’ for the government, that doesn’t mean it works for the public,” Frost wrote.

Frost pointed out that the state government needs to start spending its transportation money more efficiently before they go bobbing for revenue.

Washington’s roads are in a sorry state, and in need of an overhaul, Jessup explained, citing a 2013 report from the American Society of Civil Engineers that gave Washington a D+.

However, Gov. Inslee is slow to act, believing that we need increases in tax revenue, whether from this by-mile tax or the recently defeated carbon tax.

Inaction cannot be a policy response. Washington state’s transportation department has plenty of money, but it wastes far too much of it. Before we raise taxes, let’s look at the budget and ask ourselves: is there a way to get the money we need by getting rid of wasteful programs?

What Washington needs is leadership that isn’t afraid to cut spending in non-essential areas in order to fund things that we really need, like roads. Until then, Gov. Inslee is letting Washington down.

Harrison Conner is a junior economics major from Stanwood. He can be contacted at 335-2290 or by [email protected]. The opinions expressed in this column are not necessarily those of the staff of The Daily Evergreen or those of The Office of Student Media.