Neill Public Library hosts tax preparation assistance

VITA to help with taxes almost every Saturday afternoon until April 8.

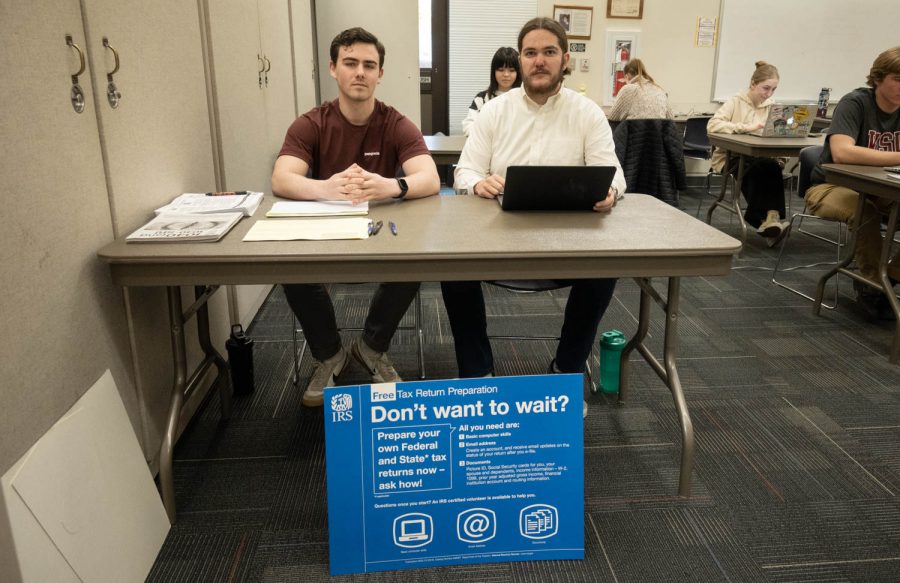

Will Hunt (left) and Johnathan Lyga (right) on Saturday, Feb. 11, 2023.

February 16, 2023

Neill Public Library will be hosting a tax preparation assistance program almost every Saturday from Feb. 4 to April 8 from 12 p.m. to 4 p.m.

Library Director Dan Owens said the program is run by the Volunteer Income Tax Assistance Program. The program will be held every Saturday except March 11 and 19.

“This is a program that started several years ago and the students contacted us,” Owens said. “It’s an important service for the community and it’s welcomed every year.”

Owens said the first time the event was held was in 2018 when the library was approached by VITA to hold it there. It was in person for about the first two and half years of its existence.

About 100 people, plus or minus a few, get assistance from the program every year, Hunt said. Last year the VITA assistants were able to bring back over $100,000 by helping people with their tax returns.

Owens said the program is in-person this year.

“They did it in person in 2018 and 2019. 2020 I believe they started but obviously, we had to cancel everything,” Owens said. “2021 they did it online. 2022 they did it in person but you could also make an appointment online if you didn’t feel comfortable doing it in person.”

Owens said the event not only helps people file their taxes, but also can answer any questions they have about filing them. The program usually does not interfere with any of the library’s regular operations.

Senior finance major William Hunt is the president of VITA. Hunt said the goal of the program is to help low-income families, individuals and the elderly, especially during tax season.

“The goal of the program is to bring back as much money to the local community as possible,” Hunt said. “Really it’s just about making sure people know about all the different opportunities for tax credits that they have, what they are and how to utilize them so they can get the best returns possible.”

Hunt said VITA is mostly made up of accounting and finance students, although there are students from many different areas of study. All the members are IRS certified.

“I joined the program last year and when I first joined the program you’re just a basic tax repayer, that’s what our basic membership is,” Hunt said. “Right now I think we have 19 people who are certified in the program. They’re volunteers, so any day any amount of people may show up.”

The program is self-contained by VITA requiring no assistance from the library staff. The main things the library does for them is provide the space and promotion for the event.

“Everything’s normal at the library on those days. The VITA volunteers are in our meeting room, so they’re separate, I guess you could say they have some privacy,” he said.

Hunt said that while he may be the president, it is more than anything a team effort. Some of the most common questions the volunteers get are from people who want to confirm they have filed their taxes correctly.

“I’d say [my job is] to just make sure everything goes according to plan and to provide help not just to people at the event but our members at the program to make sure everything’s going right,” he said.

Hunt said less than 10 people came to the event on Feb. 4, but that is to be expected as the first day is usually slow. The main thing people should keep in mind before coming to get help is that they need to have their tax documents on them.

“People want to come and have help from our services, and they really just need to make sure they need to bring the documents they need,” Hunt said.