Visiting economist explains new tax bill to students

He said bill could cost $65 billion to students over 10 years

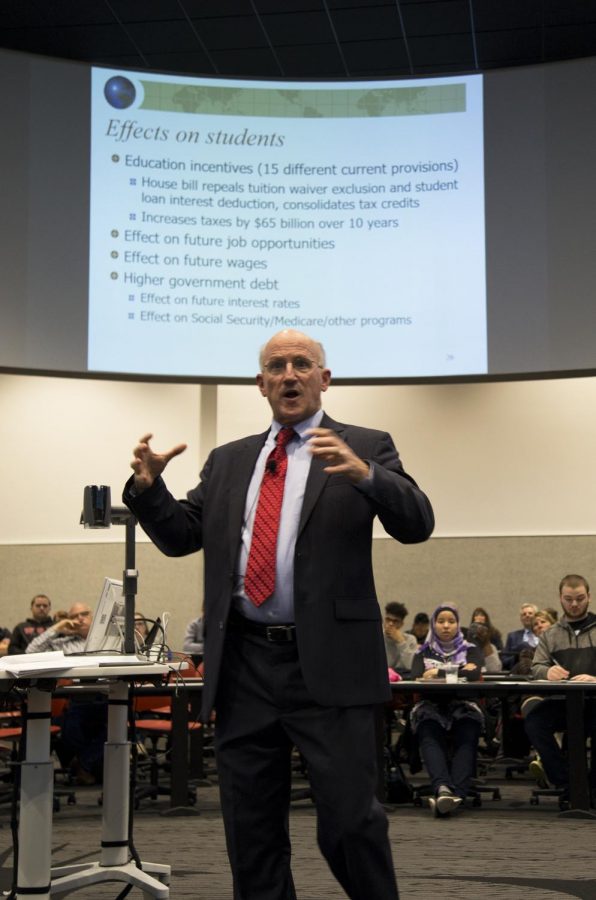

ZACH RUBIO | The Daily Evergreen

Thomas Neubig explains the benefits of possible tax reform and what it would take to become reality.

November 30, 2017

A country’s tax system is a reflection of their priorities, a visiting tax policy expert and economist told students and faculty during an on-campus symposium Wednesday.

Thomas Neubig, founding member of the Tax Sage Network, a group of experienced tax policy economists, said that there are big policy issues in this year’s tax reform bills. As an economist, he believes that it is important to focus on the economics that underlie the tax system. He said policy makers must consider potential trade-offs when making decisions that might affect economic growth, efficiency, fairness, simplicity and certainty.

He said the tax bill Congress is currently considering singles out higher education and seriously affects students.

He said the tax plan would decrease education incentives, such as repealing the tuition waiver exclusion and removing the student loan interest deduction. All together, that would increase student’s taxes by $65 billion over 10 years.

The tax reform will also affect future job opportunities, future wages and increase government debt, he added.

Senior accounting and finance major Emily Grose, who attended the event, said taxes on tuition would negatively affect students, but it’s still hard to know exactly what those impact would be.

“I wish there could be more studies on the effects of the different changes, Grose said, “because it’s really hard to say what one thing is going to do or not.”

Outside of college students, Neubig said the bill could have serious affects in other areas, such as corporations and income tax.

The U.S. is a relatively low tax country compared to the top-35 developed countries in the world, placing 31, he said. In addition, the U.S. is said to rely heavily on income taxes compared to other countries, who rely more on consumption taxes. He said the current 39 percent corporate tax rate, which is much higher than other countries such as the United Kingdom, is a driving force behind the current tax reform efforts in Congress.

“Thirty-one years ago, I was in [the] U.S. Treasury when we put out a tax reform plan and the president made some changes and it finally got enacted in 1986,” Neubig said. “There was a different motivation for that 1986 Tax Reform Act… it increased taxes on corporations and lowered taxes on individuals, and that is exactly the reverse of what is happening in this tax reform bill.”

Neubig said tax reform could occur because of strong pressure from the public on the Republican-controlled congress. He said the principles that President Trump and Congressional Republican leaders seem to be attempting to implement are making an equal playing field for American businesses and workers, and making the tax code simple and easy to understand.

“When we were doing tax reform in the mid 1980s, the general economic principles are growth, efficiency, fairness, simplicity, administrability and certainty,” Neubig said. “In some cases, you can find a particular tax proposal achieves all of those, but in most cases, you’re having to make difficult political decisions…that’s what politicians are struggling with.”

Neubig said that there are eight hurdles that any tax bill needs to go through and three have already been cleared.

“If the senate can pass its tax legislation this week, they might not go to the reconciliation process, they could essentially eliminate some of these hurdles and the house can simply take the Senate bill, pass it so then you have the same legislation,” Neubig said. “President Trump could sign it—and it would be law.”