OPINION: United States should adopt simple business tax code with low rate

Large corporations find loopholes; high taxes hurt small business

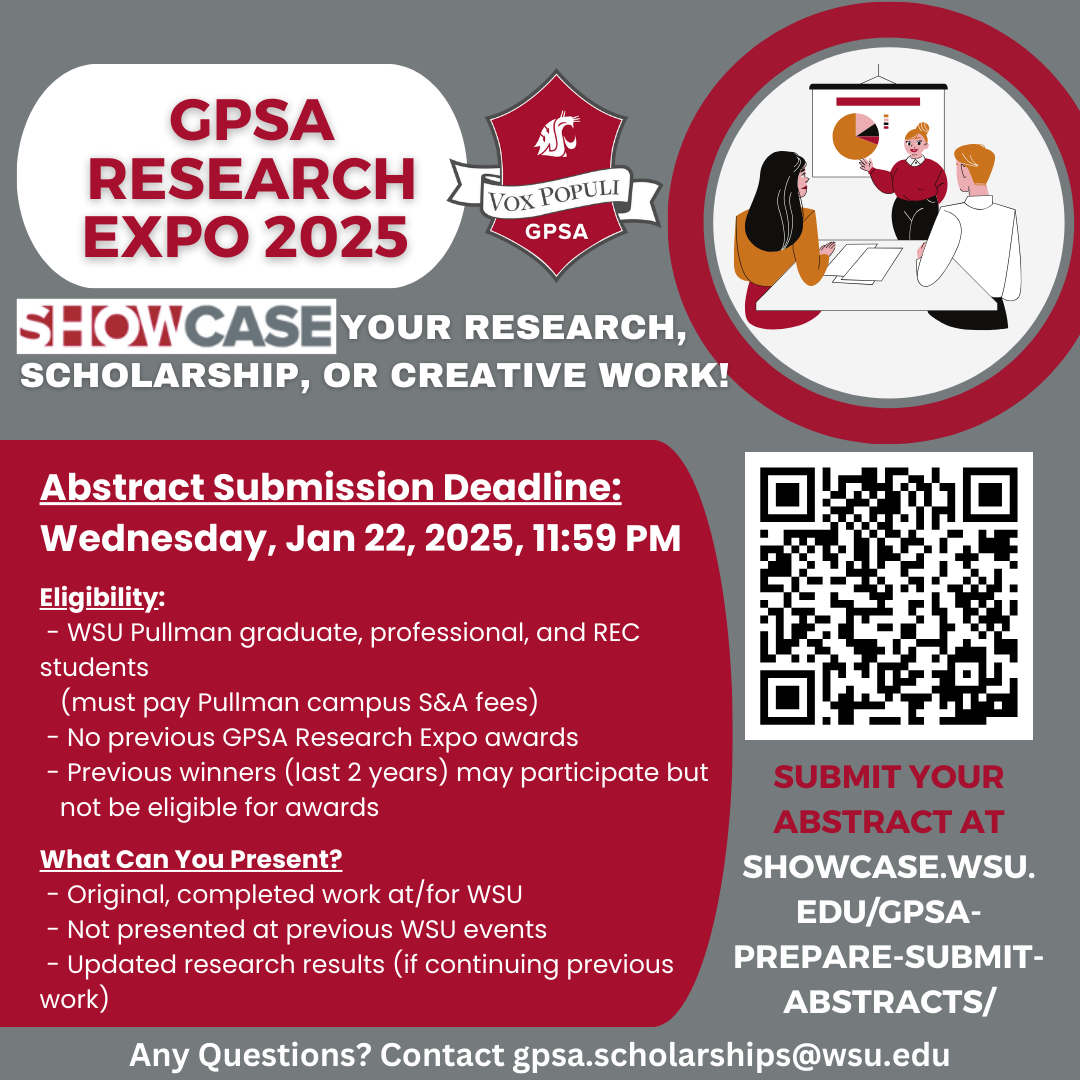

FEIRAN ZOU | DAILY EVERGREEN ILLUSTRATION

Multinational corporations find loopholes to avoid paying the brunt of taxes proposed by the government, but small businesses are unable to do the same and have to take the hit.

November 15, 2019

The U.S. should adopt a business tax code that is simple, with a low rate so that multinational corporations are no longer able to avoid paying taxes by funneling money overseas.

The U.S. loses roughly $80 billion every year in corporate tax revenue because corporations are able to move their money overseas to avoid paying the higher corporate tax rates the U.S. has.

Corporate tax law is complicated and boring, but it deserves a rundown.

Mark Gibson, WSU clinical associate professor in the school of economic sciences, said there are two types of corporations in the U.S., S corporations and C corporations.

S corporations are generally smaller companies, and profits are shared directly among shareholders. Generally, they aren’t large or complex enough to take advantage of international tax havens overseas.

C corporations, because of their larger size, are taxed at a higher rate than smaller corporate entities, Gibson said. They are currently taxed at 21 percent of their yearly income.

Counties that are tax havens have corporate tax rates that are far lower than the U.S.

An example of this is Switzerland, where a low corporate tax of 12 percent enables Starbucks to locate a trading subsidiary there, and then sell its coffee abroad, and pay far less tax then they would otherwise pay.

Essentially, multinational corporations go country to country and look for the lowest tax rates, then they establish a headquarters there and sell their products to larger market countries.

“It sounds like they’re following the letter of the law, but not the spirit of the law,” said Walter Sheppard, owner of Palouse Games in Pullman. “The fact that these loopholes exist in of themselves is duplicitous.”

While multinational corporations are able to use complicated legalese to avoid paying corporate taxes, small businesses like Palouse Games pay much different taxes.

“When it comes to owning a small business, the taxes are pretty straight forward,” Sheppard said.

He said that his business pays about 7.8 percent of their income, with no loopholes or real opportunities to avoid taxes.

“It’s never been a problem for us,” Sheppard said.

This begs the question if tax law for small businesses is easy to navigate, straightforward and gets businesses to pay their fair share of taxes, shouldn’t we tax multinational corporations the same way?

Yes, we should.

“What would be best is to have a simple code with relatively low rates, broadly applied,” Gibson said.

Having a low, simple tax rate would force multinational corporations to reconsider where they are located.

It would bring multinational corporations home and erase the loopholes that enable them to get away with corporate tax evasion.

If the U.S. can recuperate some of the $80 billion per year that multinational corporations owe the American people, then it would be a crucial victory for everyone, from small business owners to schoolchildren.