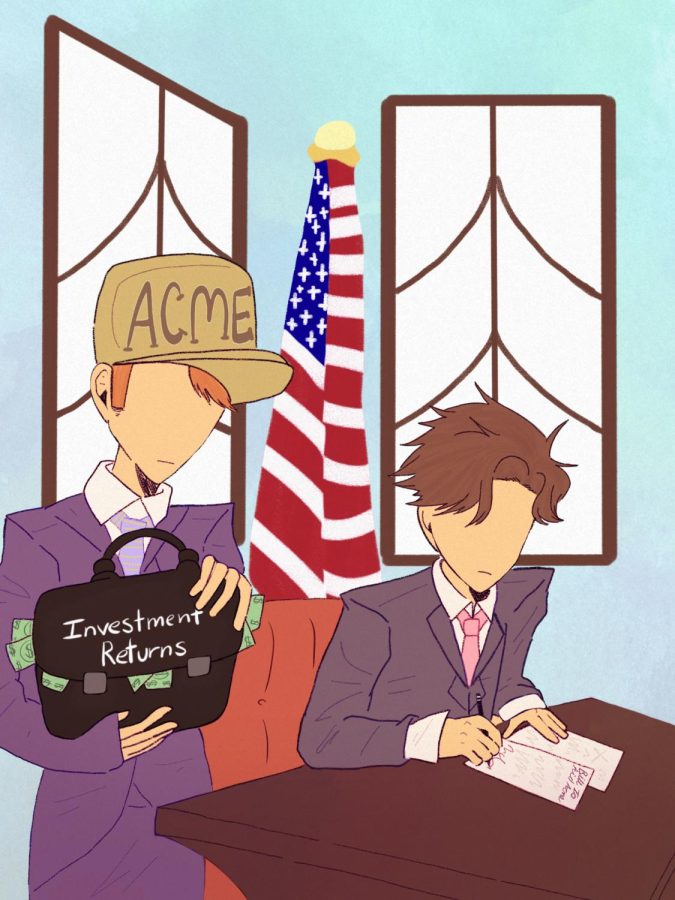

OPINION: Members of Congress should not use positions to make money

Elected officials should focus on representating constituents, not enriching themselves

Producing legislation that benefits their own investments gives Congress an unfair advantage over other investors.

January 27, 2022

Georgia Sen. Jon Ossoff plans to introduce a bill that would target loopholes utilized by members of Congress for trading or holding individual stocks while in office.

The bill is very much in its infancy, and Ossoff is currently trying to drum up support from both parties.

This feels like a refreshing step in the right direction but underlines a dangerous problem that has been floating just at the surface of our democracy. At the expense of their constituents, Congressmembers have been using their position to enrich themselves while in office.

During their time in office, members of Congress wield an incredibly dangerous imbalance of power.

They can produce or sponsor pieces of legislation carrying the full weight of law behind them that can benefit their investments or those connected to them. They are privy to information and policy recommendations that would put them at an unfair advantage in the stock market.

This information and power are not afforded to the average stockbroker, much less the average American.

It is unlikely that Ossoff’s bill will receive enough support to get it passed through both chambers of Congress. It is very possible it will be shot down by the upper leadership of the very same party he is a part of.

House Speaker Nancy Pelosi is among the members of Congress who have acquired wealth from these loopholes with a net worth of around $46 million and growing. She has previously voiced her opposition to any efforts to close the loopholes.

This is a problem across both sides of the political spectrum, and it becomes increasingly apparent that the politicians most against this piece of legislation are the ones benefitting from it.

Zachary Nett, senior computer engineering major, said this is a concerning development, and there needs to be a change in the system.

“Congress is elected to uphold the needs and wants of those who elected them. The legislation they pass is supposed to reflect that,” Nett said. “The priority should be to represent people, not make money.”

To forestall any protests to the rest of this article, I am not calling to cut the salary of Congress completely. Even though members of Congress make nearly three times the average American’s salary, they fulfill an important role in our political system, and it is a tough job.

Rather, I agree with Ossoff’s legislative efforts to mitigate the problem. Members of Congress should not use their positions to pass laws that benefit their investments.

Ostensibly this should already be in place with current laws and regulations. The Obama administration implemented the STOCK Act, or Stop Trading on Congressional Knowledge Act, in 2014 to prevent members of Congress from making money off of investments in their position.

Despite this, members of Congress have found a variety of ways to skirt the rules. If not breaking them in practice, they do so in spirit by using senior officials or their family members.

Lawmakers and top congressional staffers have invested in several different companies and ventures often when they have connections with those policy decisions, according to the Insider’s Conflicted Congress project.

I would more than recommend checking the Insider’s report, which has been laid out in an easy-to-read chart. Find your representative and senator and start down the dangerous rabbit hole of how much money they are making off being in Congress.

Members of Congress circumnavigating the rules to make large sums of money is a situation that dives to the heart of the problem. Even if they are not overtly breaking the rules, seeking loopholes violates the spirit of the law.

“If every Congressmember is just there to make money, that is a big problem,” Nett said. “Corruption, even through loopholes, in Congress is not a good thing.”

It is important to note that not every elected official is out to drain U.S. taxpayers of every cent they can get. There are those in Congress who want to do the job they were elected for with their paid salary.

However, legislation and regulations are needed to prevent those who take advantage of the job.

Freshman psychology major Jack Zimmerman sees the problem of insider trading in Congress as an important issue to be tackled.

“Congress needs to pass bills and laws that benefit the people,” Zimmerman said. “I don’t think it is right for them to make money that way when it doesn’t benefit anyone but themselves.”

Public officials should not use their positions to make more money than is allotted to them by their salary. It turns an elected position into a sought-after cash grab.

The reward for public service ideally is not a bigger dollar sign on your bank account at the end of your term.

If a member of Congress wishes to go into business or stock trading after they are out of office, then they should be able to; likewise, prospective politicians should not be penalized for business done before they took office, provided it was properly reported and is publicly accessible.

Unfortunately, this balance simply is not there in the status quo.

Legislation revolving around closing these loopholes is important to reducing institutionalized and accepted corruption in our government. The fight does not end there, however.

The initiative by Ossoff represents a baby step in holding politicians more accountable and transparent to the people that they claim to represent. The priority of our members of Congress should be doing the jobs that we continuously harp on kids about in their civics classes.

I will be following the progress of Ossoff’s bill closely, though I am not hopeful – it may equally receive bipartisan support and opposition. But, if the bill gets passed, we can celebrate the first success on a long journey.

More likely, though, when the bill fails, we need to take a long and hard look at which members of Congress opposed the actions and their climbing investment portfolios.

Either way, this is a problem that we all need to be conscious of when checking that ballot box.