WSU administration reviews debts, fiscal health

University considers treasury, regents delegate to president

MICHAEL LINDER | DAILY EVERGREEN FILE

Chair of the Board of Regents Theodor Baseler, right, and board member Lura Powell listen at a September Board of Regents meeting. WSU President Kirk Schulz can carry out certain financial policies without the board’s approval.

February 21, 2018

Halfway through the fiscal year, WSU’s higher administration is still considering strategies to resolve the university’s $30-million deficit by updating the university’s finance and borrowing systems, forgiving certain expenses and communicating with university leaders.

Stacy Pearson, vice president for finance and administration, said university officials met recently to look at WSU’s financial standing. While they have made progress, she said, there is still more to be done.

“We’re working very diligently to help colleges and organizations make this turn around to be more fiscally healthy,” she said, “but it is going to take time.”

One idea they have to improve the university’s financial system is to create a “treasury function,” like many large organizations. Pearson said WSU would need to establish a reserve that units can borrow from, but that is not possible under the current budget situation.

The treasury function works much like a bank, Pearson explained. For example, she said, a department could take out a loan from the treasury after submitting a business plan, and then pay it back with interest. Revenues from interest would fund the treasury’s operations, she said.

In addition to lack of a treasury function, Pearson said, WSU’s 40-year-old financial system adds to the challenge of managing finances. She said part of the problem is the system does not help regulate overspending because it does not put holds on transactions, so people have to pay attention to spending decisions university-wide.

WSU has an enrollment-based budget model, she said, so finding classes and degree programs that generate additional enrollment can be helpful. For example, she said, the Carson College of Business is financially healthy because it has a successful online master of business administration program.

Phil Weiler, vice president of marketing and communication, said senior leaders from academics and administration have been holding “budget summits” to discuss how to fix financial problems. He said the summits seem like a healthy way to solve issues and bring everyone’s voice to the table.

“We’re all in this together,” he said.

In addition to working with university and administrative leaders, Weiler said, WSU President Kirk Schulz wants to make sure the regents understood his thinking and actions.

“They delegate authority to the president in a pretty broad way,” Weiler said.

However, Pearson said she is unsure whether the regents played a role in Schulz’ recent decision to forgive the College of Arts and Sciences’ deficit of $3.2 million. She said the college will not be held responsible for those funds, but they cannot spend into deficit in the future. The $3.2 million is included in the university’s $30 million deficit.

Weiler said he does not know whether the regents were involved in past loan forgiveness decisions while Elson S. Floyd was president.

Pearson said the regents can bring up questions about financial decisions if they have any, and that it is possible they will have questions about Schulz’s decision to forgive the College of Arts and Sciences debt, but she does not know for sure.

Michael Poliakoff, president of the American Council of Trustees, said the key responsibility of regents is to be fiduciaries of the institution, to review decisions about the allocation of financial resources very carefully.

“It is their solemn duty to be well-informed and make fiduciaries decisions about the budget,” Poliakoff said.

He said although the regents are supposed to be highly involved in financial decisions, that does not mean they should interfere with day-to-day operations of the senior management or department decisions about instructional priority.

Poliakoff said senior administration has prerogatives within the budgetary lines the regents have set, but if they want to make any changes they should consult with the board.

“It is always the best policy for the institution to be as transparent as possible,” Poliakoff said.

Weiler said Schulz has opted for “retreats” with the board instead of business-oriented meetings to go more in-depth.

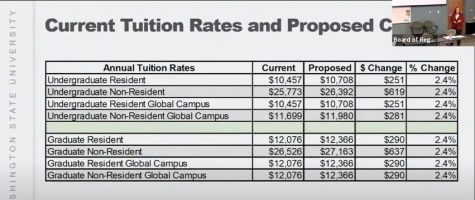

At previous meetings, the regents would spend 20 to 30 minutes on one action item, which is not enough time to dig deep into issues, Weiler said. In comparison, at the last retreat they spent 90 minutes talking about student fees alone, he said.

The Board of Regents’ administrative assistant did not respond to requests for comment.

This article has been updated to reflect that the Board of Regents are fiduciaries of the university, not judiciaries.